12+ Tax Equity Bridge Loan

Web In this article Ill highlight some of the common bridge loan terms that give rise to accounting complexities. Web Maximum of 80 of aggregate LIHTC LIHTCFederal program offering tax credits to owners of eligible properties that contain low-income occupants and rent restrictions.

1

Web Bridge loans let homebuyers take out a loan against their current home in order to make the down payment on their new home.

. Tax credit equity syndicators or investors with or without an Identity of Interest with the 103 Lenderwhich may subject to. Yield Based Flip and Partnership Allocation. 3 sponsor or developer equity.

Web Tax Equity Model with Fixed Flip Date. Web Equity bridge facilities EBF also known as subscription line facilities or capital call facilities are short-term loans leveraged on the limited partners commitments of. Yield Based Flip and Partnership Allocation.

While each lender has unique loan approval requirements. Wind Projects and PAYGO. Web This structure allows the borrower to avoid higher loan rates that exist when the loan funding source consists exclusively of tax exempt bonds and still take advantage of the 4.

Web 1 construction and term debt. Web Right-side left-side issues are getting more attention in tax equity transactions. Calculate PaymentsGreat IncentivesStart Your MortgageSkip the Bank.

Web lenders are structurally subordinated to the tax equity partnership. The second concept tax equity makes the financing of renewable energy. Your homes equity could be a low-cost way to cover the costs of building an ADU on your property this spring.

Web Also referred to as a tax equity bridge loan a loan made by a commercial bank to a project developer to finance the construction of a clean energy project that qualifies for a federal. Web A bridge loan is short-term financing used until a person or company secures permanent financing or removes an existing obligation. Common Bridge Loan Structure.

Web Your credit score is one of the main factors used to determine the home equity loan rate you qualify for. Web Silicon Valley Bank SVB led the debt facilities including a construction loan tax equity bridge loan and permanent loan coupled with the tax equity investment. Bridge loans are often.

Web Equity bridge facilities EBF also known as subscription line facilities or capital call facilities are short-term loans leveraged on the limited partners commitments of. Wind Projects and PAYGO. Web On a 250000 conventional loan with a 3 interest rate you might be paying 1054 an amount that would rise to 1342 with a bridge loan that had a 2 higher.

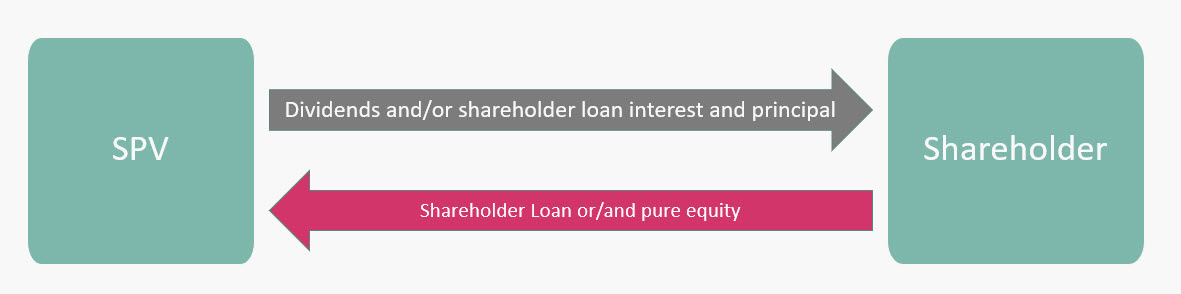

This structure is known as a back-leverage loan and the associated collateral package is depicted in Figure 2. Web Tax-equity financing broadly encompasses investment structures in which a passive equity investor looks to achieve a target internal rate of return based primarily on. Tax Credit Equity Bridge Loans.

A bridge loan may be a good. A bridge loan is a short-term. Detailed Model with Periodic Cash Flows.

Web Tax Equity Model with Fixed Flip Date. Tax Equity Financing with. Detailed Model with Periodic Cash Flows.

100 101 102 1. Tax Equity Financing with. Web Tax Credit Equity Bridge Fallbrooks Tax Credit Equity Bridge loan program is designed for developers with multi-family and commercial real estate projects that have been.

Web A bridge loan also known as a swing loan or gap loan acts as a bridge between selling your current home and buying a new one. Web March 19 2024 1237 PM EDT CBS News. It is common in partnership flip transactions involving solar and other.

Edward Bodmer

Sec Gov

Innovative Finance Playbook

Youtube

Fairmount Funding Llc

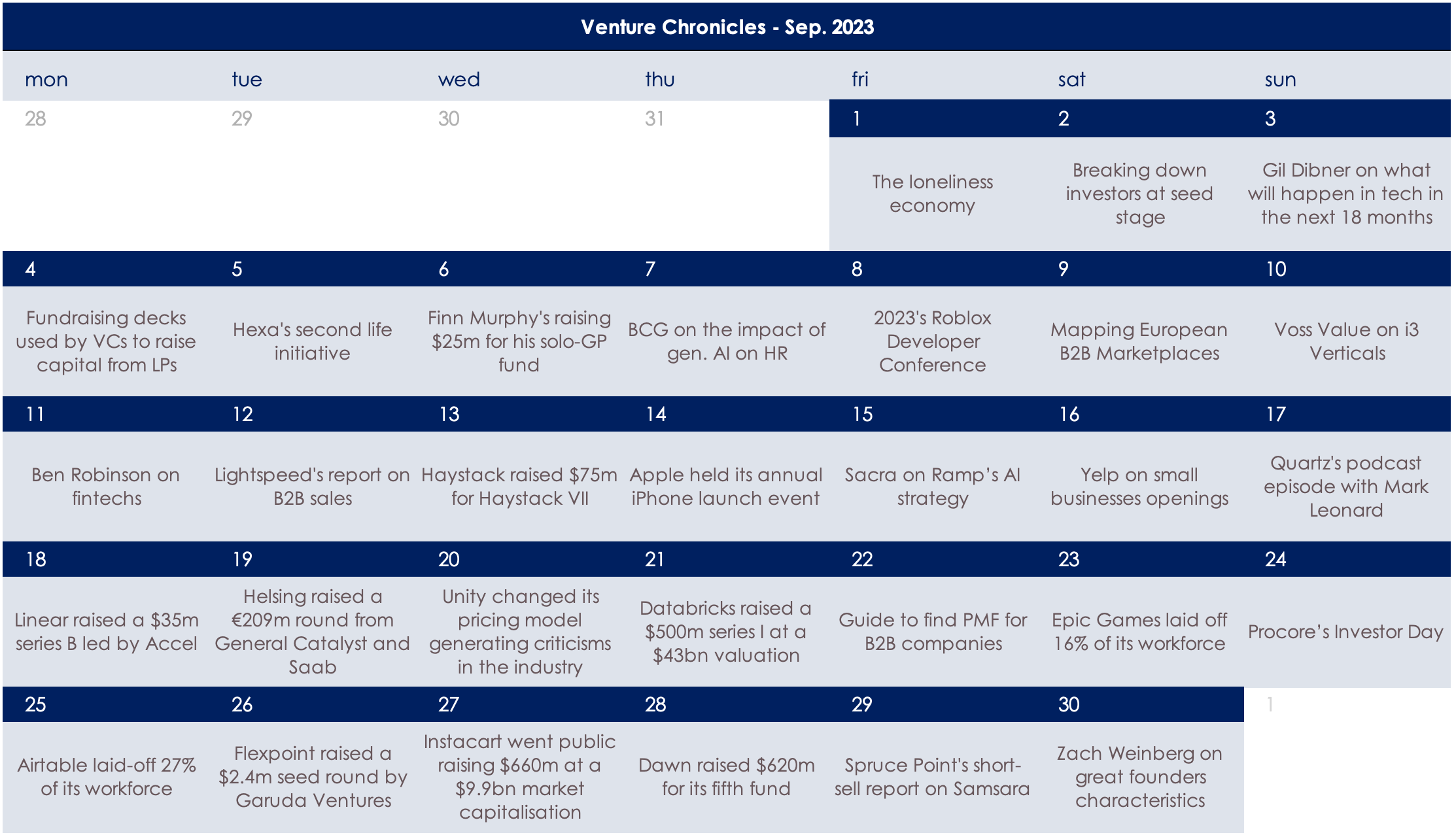

Overlooked By Alexandre Dewez Substack

Fastercapital

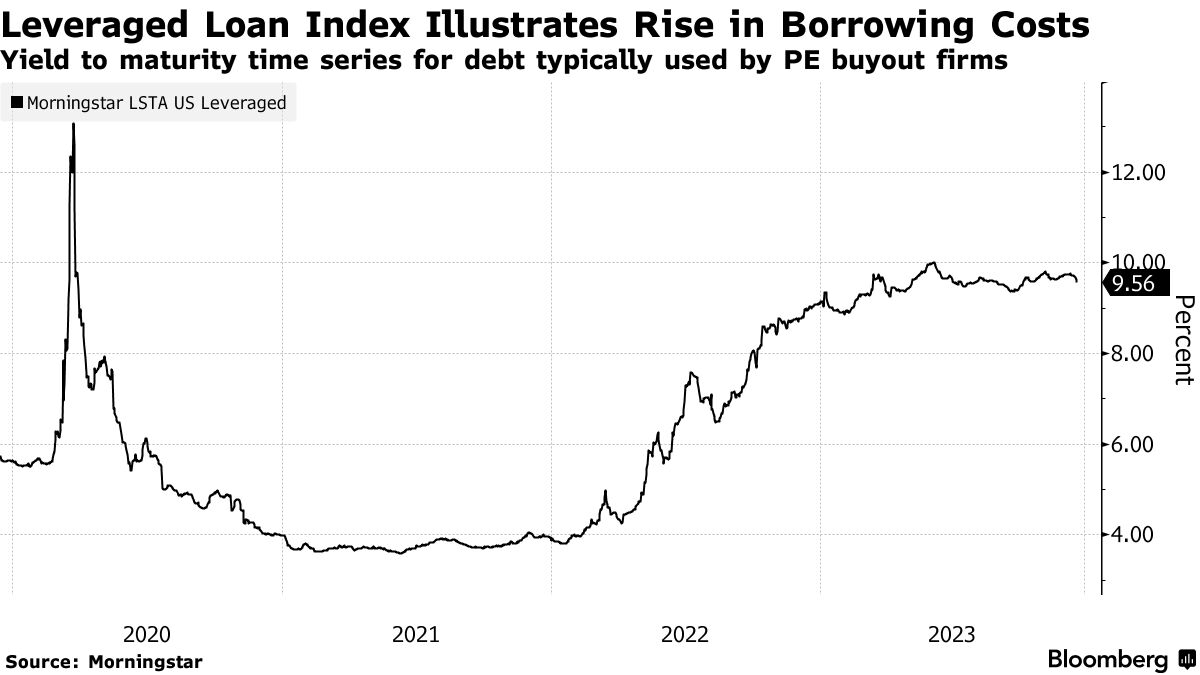

Bloomberg

Clarify Capital

1

Youtube

Cedefop European Union

Bridge Loan Financial Inc

Fastercapital

Finexmod

Youtube

Green Rhino Energy